HOW-TO

Pay Off Student Loans Fast 2022

A proven step-by-step guide to pay off student loans fast.

best for:

- Lowering Monthly Payments

- Get out of default

- Stop wage garnishment

- Public service loan forgiveness

- Borrower defense to repayment

Let’s dive right in.

Must-Know Definitions

Forbearance

Your loan payments are postponed (or reduced) but interest continues to accrue during the period of forbearance. If you don’t pay the interest during that period, the interest

may be “capitalized,” which means it is added to your principal balance

Principal

The total sum of money borrowed plus any interest that has been capitalized.

Deferment

It is a time during which a borrower does not have to pay interest or repay the principal on a loan.

Subsidized Loans

Loans that do not accrue interest while you are in school at least half-time or during deferment periods.

Unsubsidized Loans

These are loans that are federally guaranteed loans that are available for students who desire to pursue an education, but lack the financial resources to do so. These loans are not based on financial needs. Interest on the unsubsidized student loans starts to accrue

as soon as the loan is disbursed to the school.

Default

Failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, you will default if you have not made a payment in more than 270 days.

Direct Loan

A Federal student loan, made through the William D. Ford Federal Direct Loan Program, for which eligible students and parents borrow directly from the U.S. Department of Education at participating.

Federal Family Education Loan (FFEL)

Program Under this program, private lenders provided loans to students that were guaranteed by the federal government. These loans included Subsidized Federal Stafford Loans, Unsubsidized Federal Stafford.

FFE Program

Federal Family Education Loan Program.

Guaranty Agency

A state agency or a private, nonprofit organization that administers Federal Family Education Loan (FFEL) Program loans.

Lender

The organization that made the loan initially; the lender could be the borrower’s school; a bank, credit union, or other lending institution; or the U.S. Department of Education.

Collection Costs

Expenses charged on defaulted federal student loans are added to the outstanding principal balance of the loan. These expenses can be up to 18.5 percent of the principal and interest.

Loan Forgiveness

The cancellation of all or some portion of a remaining federal student loan balance. If a loan is forgiven, the borrower is no longer responsible for repaying that remaining portion of the loan.

Interest Rate

The percentage at which interest is calculated on loan(s).

Federal Student Loan

A loan funded by the federal government to help pay for education. A federal student loan is borrowed money you must repay with interest.

Direct Consolidation

Loan A Federal loan made by the U.S. Department of Education that allows a borrower to combine one or more federal student loans into one new loan. As a result of consolidation, a borrower will only have to make one payment on their federal loans and the amount of time they have to repay their loan will be extended.

DZ loan status

Loans that were in an XD (formerly DX) status, but the borrower missed one or more payments or otherwise did not comply with the repayment agreement. A loan is eligible for an XD (formerly DX) status only one time. Once a loan becomes a DZ, it remains in this status until closed.

A loan can be in this status only once in the life of the loan.

Defaulted Unresolved

A loan on which the borrower defaulted, the school is pursuing collections, but the borrower has not made at least six consecutive payments on the loan. This includes defaults that are being contested.

Chapter 1

Finding and Organizing Your Student Loans

You must first determine how much student loan debt you have before you can begin digging your way out.

Accessing Student Aid Account

To begin go to https://studentaid.gov/ Create or recover your FSA account.

Many borrowers do not have an account created or have lost their login credentials. An FSA account will be your main tool while processing your direct consolidation loan and/or IDR application. And where you can locate most of your student loans.

Recover Account

You can use your verified phone number, verified email address, or the answers to your challenge questions to get back into your account.

You won’t be able to use them to recover your account if you didn’t verify your contact information during the account creation process.

If you have to use your challenge questions to reset your password, you’ll have to wait another 30 minutes before being able to log in to your account for security reasons.

If you have an FSA account and you are unable to reset the account you will need to

Call the FSA Reset Line

800-433-3243

Recover Account

If you find out after completing this procedure that you don’t have an FSA account or already know you don’t, you’ll need to set up yourself and an account.

This is a fairly simple procedure, similar to creating another email address. Fill out the necessary forms and confirm your email and phone number.

After completing your account creation, you will not be able to use your new account for 24-48 hours.

You will receive an email informing you when your Social Security number has been verified.

Credit Report to Find Student loans in Default or Collection.

A great way to do so is by pulling a credit report.

If you believe you may have student loans that you’ve misplaced track of, search for them.

Pull a credit report, then check for debts and accounts you might have missed.

Website to pull all three major credit report bureaus

Organizing Your Student Loans

Even if you’re not a natural-born organizer, creating a spreadsheet or working document might be extremely beneficial when it comes to tracking down your student debts. The more loans you have, the more valuable it will be.

For Google Sheet Users- You can use this Student Loan Check List template below.

This template contains the following columns:

Type of student loan

Note whether your loan is federal or private, and subsidized or unsubsidized

Name of loan servicer (company managing the loan).

If you have separate loans with the same servicer, list them separately.

Contact information for the loan servicer.

List their phone number, e-mail, and website so you can easily get in touch when you need to. Date the loan was disbursed (given out).

This date may determine some loan benefits you’re eligible for, so keep it on hand.

Loan interest rate.

In addition to the rate, note whether the interest rate is fixed (the same over the loan’s life) or variable (subject to change over the loan’s life). Ask your servicer for this information if you don’t know.

Loan status.

Is your loan in repayment, in deferment, in forbearance, or in a grace period? Total payoff amount on loan. This number may be intimidating, but it’s an important one to remember – and gratifying to watch reduce over time.

The monthly payment amount.

Fill out this column even for loans not currently in repayment, so you don’t lose track of the loan. Next payment date, or the date when the grace period ends.

This is the column you’ll probably be updating the most often.

You can now have all of the information at your fingertips. You’re more likely to figure out the best repayment strategy if you have it all in one spot. Make sure to keep the rows up to date as payment plans alter over time.

Chapter 2

How to Get Student Loans out of Default / Wage Garnishment.

For most federal student loans, you will default if you have not made a payment in more than 270 days.

There are two ways you can go about this depending on your situation.

if your loans are in default because you are unable to afford the monthly payment and are not yet being garnished you can consolidate your loans to get the defaulted ones out of default status.

Consolidate Loans

One of the first things borrowers should do after they complete school is to consolidate their loans. Loans are generally broken up into smaller loans each semester that you attended college and if you attended college over a series of years you could also have multiple interest rates.

This compounding interest can significantly harm borrowers. If you have FFEL loans or FFEL Consolidated loans you will need to re-consolidate again to become eligible for the forgiveness program.

Some additional requirements apply before you are able to consolidate your loans.

You must either: make three consecutive, reasonable, affordable payments on your loan, or establish a repayment plan under the Income Contingent Repayment (ICR) or Income-Based Repayment (IBR) plans.

Consolidation Process

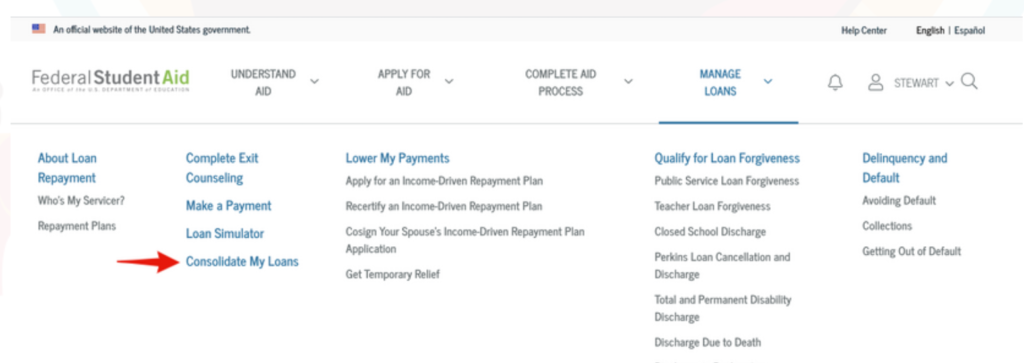

Log in to studentloans.gov and click on “Consolidate My Loans”

Stop Wage Garnishment

The second option for getting a student loan out of default and stopping wage garnishment is loan rehabilitation.

A borrower can also get out of default status on federal student loans by completing a loan rehabilitation process.

With loan rehabilitation, you make nine timely voluntary loan payments over a period of ten months.

The payments must be “reasonable and affordable” based on your total financial circumstances.” What is “reasonable and affordable” for you will depend on your personal circumstances.

Rehabilitation payments must be voluntary — that is, the payment towards the loan cannot come from a garnishment or tax refund offset.

To set up a voluntary payment plan. refer to the https://myeddebt.ed.gov/ and create a collection account.

Your loan is rehabilitated only after you have voluntarily made the agreed-upon payments on time and the loan has been purchased by a lender. Outstanding collection costs may be added to the principal balance.

Note: Payments that have already been collected from you — for example, through the Administrative Wage Garnishment (AWG) process or through legal action taken against you to collect a defaulted loan—do not count toward rehabilitation payments. (Through AWG, payments will be deducted from your wages until the defaulted loan is removed from default status.)

Benefits After Student Loan Rehabilitation

Once your loan is rehabilitated, you may regain eligibility for benefits that were available on their loan before they defaulted.

Those benefits may include deferment, forbearance, a choice of repayment plans, loan forgiveness, and eligibility for additional federal student aid. Other benefits of loan rehabilitation include the removal of

1. The default status on the defaulted loan,

2. The default status reported to the national credit bureaus,

3. The default status is reported to the national credit bureaus, wage

garnishment, and any withholding of your income tax refund made by the Internal Revenue Service (IRS).

After rehabilitation, your monthly payment may be more than the amount you paid while you were rehabilitating the loan.

Collection costs may be added to the principal balance, increasing the total amount you owe. Delinquencies (late payments) reported before the loan defaulted will not be removed from the credit report.

Note: A collection agency may charge collection or late fees up to 18.5 percent of the outstanding loan (including the principal and interest).

The fees become part of the principal for the consolidation loan.

For example, a defaulted loan of $8,500 plus $1,500 of accrued interest = $10,000. Fees of $1,850 can be added to the $10,000, which means the consolidation loan will be made for $11,850.

Great Advice! Income and Expense

To ensure that you receive the lowest monthly payment feasible, it is strongly suggested that you list all potential expenses.

You will also need copies of your two (2) most recent pay stubs or a copy of your IRS 1040 to submit proof of income.

After the entire interview is complete the collections agency will send you a copy of your income and expense sheet for you to review and sign. The final step will be for you to sign the Rehabilitation Agreement Letter.

Use a Prepaid Debit Card

Purchase a prepaid debit card in the amount of your entire rehabilitation payment; $45 is the minimum.

Many borrowers fail the program because their primary bank card is lost or stolen, and the collection agency will not notify you that you missed a payment.

If you don’t complete a rehabilitation program and are unable to pay off the remainder of your loan, they win.

Chapter 3

Pick The Right Student Loan Repayment Plan

You may successfully make it through the rehabilitation process only to find that the loan holder has put you in a standard repayment plan with payments that you cannot afford. You should carefully track when the rehabilitation period is over.

Once you have rehabilitated, your loan is out of default and you are eligible for any of the pre-default flexible repayment plans.

Particularly if you applied for an income-driven repayment plan, the servicer may also place you temporarily in an alternative repayment plan.

There will usually be a new servicer after your rehabilitated loan is sold or transferred.

It is a good idea to ask your current loan holder to give you the name of the new servicer as soon as possible so that you can arrange for an affordable payment plan.

Lower Student Loan Payments

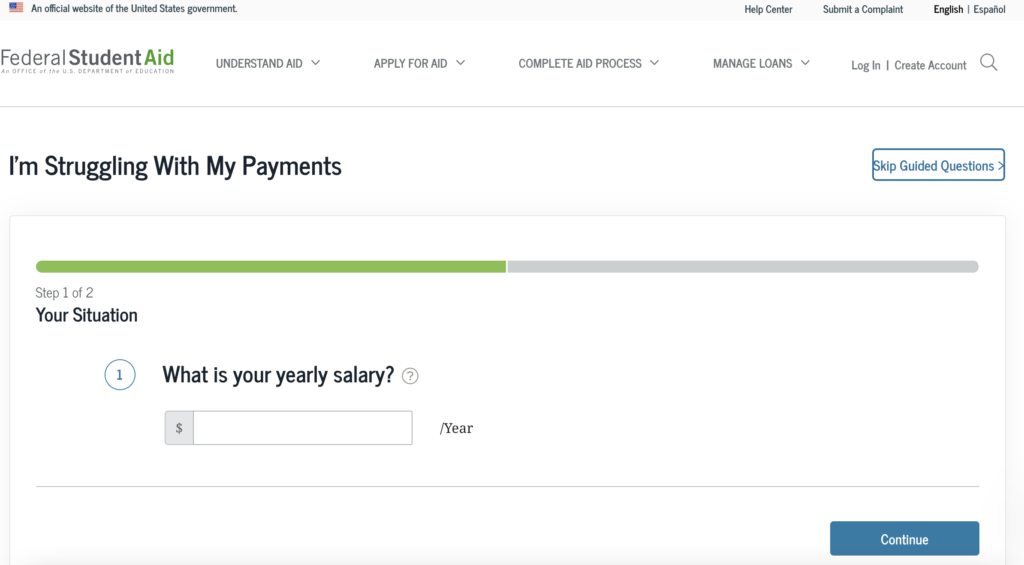

Let’s focus on understanding your actual repayment options based on your loans and income.

Visit www.studentloans.gov, click on Repayment Estimator. Log in or use the estimator with general estimates to determine your projected repayment options Based on the options provided, pick the most affordable payment plan.

The estimator option assumes the following options:

Repayment Period – It is assumed that you have just entered repayment and that you still have the full repayment period to repay your loans.

Discretionary Income – It is assumed that your income will grow 5% each year, that your family size will remain the same during the life of the loan, and that the poverty guidelines will increase based on the Congressional Budget Office’s estimation of inflation.

Variable interest rates – For loans with variable interest rates, the model assumes that the current interest rate won’t change during the life of the loan.

Consolidation Loans – It is assumed that Direct and FFEL Consolidation Loans don’t contain any underlying loans made to parents, which are ineligible for the REPAYE, PAYE, and IBR plans Projected Loan Forgiveness:

Under the income-driven repayment plans, you may have the remaining balance of your loan forgiven if your loan is not repaid in full after 240 months (20 years) or 300 months (25 years). Whether your loans are forgiven after 20 or 25 years depends on the plan you choose.

1. Revised Pay As You Earn (REPAYE)

REPAYE is right for you if you have a sizeable amount of student loan debt, are unsure if you can afford your monthly payments, or have little to no income.

Plan Features

Monthly payments are as low as $0 per month.

- Payment amounts are based on your household income (with a spouse, if applicable) and family size.

- Extended repayment period.

- Offers loan forgiveness after 20 years of qualifying payments (25 years for borrowers with Direct Loans obtained for graduate and professional study).

Payments and Term

- Reduced monthly payments are calculated using your discretionary income (with your spouse, if applicable).

- Payments are generally 10% of your income.

- Payments are made for up to 20 years (25 years for borrowers with Direct Loans obtained for graduate and professional study).

- 100% of your subsidized loan interest for the first 3 years is paid by the government and 50% of your unsubsidized loan interest is paid for the first 3 years by the government.

Note

You must provide income documentation for yourself and your spouse regardless of whether you file your taxes jointly or separately (unless you file separately because you are separated or unable to obtain your spouse’s income information).

Since the information used to calculate your payment may change from year-to- year, you must recertify annually for REPAYE.

2. Pay As You Earn (PAYE)

PAYE is right for you if you have a sizeable amount of student loan debt, are unsure if you can afford your monthly payments, or have little to no income.

Plan Features

- Monthly payments are as low as $0 per month.

- Payment amounts are based on your income and family size. Extended repayment period.

- Offers loan forgiveness after 20 years of qualifying payments.

Payments and Term

- Reduced monthly payments are calculated using your discretionary income and family size.

- Payments are generally 10% of your income.

- Payments are made for up to 20 years.

Note

If you’re married and file a joint federal income tax return, your spouse’s eligible student loan debt and adjusted gross income are also considered (unless you are separated or unable to obtain your spouse’s income information).

You must recertify annually for PAYE.

3. Income-Based Repayment (IBR)

IBR is right for you if you have little to no income, mounds of student loan debt, or you’re stressed about the affordability of your monthly payments.

Plan Features

- Monthly payments are as low as $0 per month.

- Payment amounts are based on your income and family size.

- Extended repayment period.

- Offers loan forgiveness after 25 years of qualifying payments (20 years for new borrowers*).

Payments and Term

- Reduced monthly payments are calculated using your discretionary income and family size.

- Payments are generally 15% of your discretionary income (10% for new borrowers*).

- Payments are made for up to 25 years.

Note

If you’re married and file a joint federal income tax return, your spouse’s eligible student loan debt and adjusted gross income are also considered (unless you are separated or unable to obtain your spouse’s income information).

Since the information used to calculate your payment may change from year-to- year, you must recertify annually for IBR.

A new borrower for the IBR plan has no outstanding balance on a Direct or FFEL Program Loan as of July 1, 2014, or has no outstanding balance on a Direct or FFEL Program Loan when he or she obtains a new loan on/after July 1, 2014.

Discretionary Income

For the IBR, PAYE, and REPAYE plans, discretionary income is the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence.

For the ICR Plan, discretionary income is the difference between your adjusted gross income and the poverty guideline for your family size and state of residence.

If you are married, under certain circumstances your discretionary income may include your spouse’s income.

4. Income-Contingent Repayment (ICR)

ICR is right for you if you are worried about your monthly payments and need some flexibility based on your financial situation.

Plan Features

- Monthly payments are as low as $0 per month.

- Payment amounts are based on your income, family size, and loan debt.

- Extended repayment period.

- Offers loan forgiveness after 25 years of qualifying payments.

Payments and Term

- Reduced monthly payments are calculated using your discretionary income, family size, and the total amount of eligible loan debt.

- Payments are generally adjusted based on your income using the lesser of 20% of your discretionary income the amount you would pay under a fixed repayment plan over 12 years.

- Payments are made for up to 25 years.

Note

If you’re married and file a joint federal income tax return, your spouse’s adjusted gross income is also considered (unless you are separated or unable to obtain your spouse’s income information).

Since the information used to calculate your payment may change from year-to- year, you must recertify annually for ICR.

Discretionary Income

For the IBR, PAYE, and REPAYE plans, discretionary income is the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence.

For the ICR Plan, discretionary income is the difference between your adjusted gross income and the poverty guideline for your family size and state of residence.

If you are married, under certain circumstances your discretionary income may include your spouse’s income.

Keeping Lower Monthly Payments

Include anyone you support financially during the year. By increasing dependents’ size, the payment will go lower.

Chapter 4

Public Service Loan Forgiveness

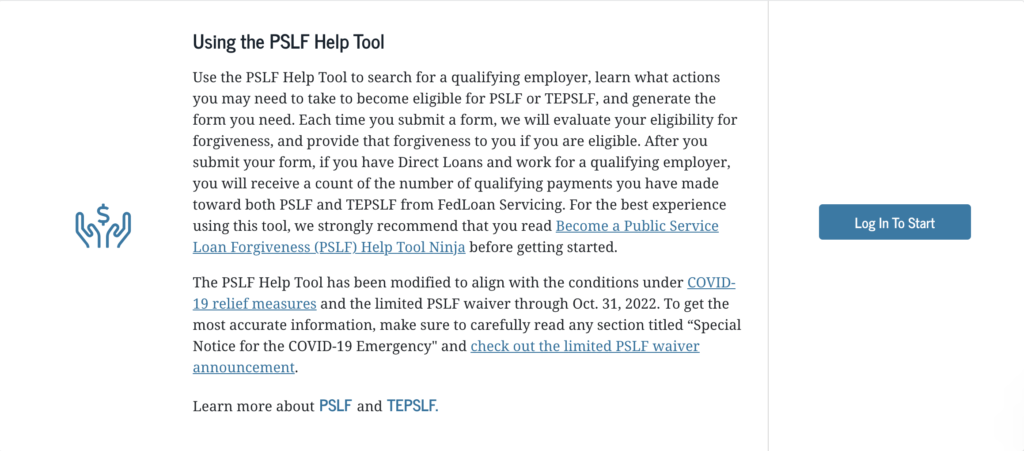

The Public Service Loan Forgiveness program is real… however, according to reports, only 1% of the eligible group received forgiveness in 2017… 99% of those who applied were misinformed and had missing paperwork. We do not want this to be you!

To be eligible for most of these programs there are a few steps you need to have in place. Make sure your loans are Federal Direct Loans or have been consolidated.

The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

To qualify for PSLF, you must

Work for a government agency or for certain types of nonprofit organizations; Work full-time for that agency or organization; * have Direct Loans (or consolidate other federal students loans to qualify);

Repay your loans on an income-driven repayment plan; and

make 120 qualifying payments.

Use the PSLF tool to determine your eligibility: https://studentaid.gov/pslf/

Here is the application form to qualify for PSLF:

Qualifying for PSLF under limited waiver programs

The limited waiver applies to borrowers with direct loans, those who have already consolidated into a direct loan, and those who consolidate into a direct loan by Oct. 31, 2022.

While grad PLUS loans are included under the limited waiver, parent PLUS loans are not.

Some federal loans are not direct loans. If you have FFEL or Perkins loans, for instance, you will need to consolidate your loans into a direct consolidation loan before October 31, 2022.

You will then need to verify that you work for an eligible employer and submit a PSLF form –– also before Oct. 31, 2022.

If you already hold direct loans, there is no need to consolidate. Rather, you just need to verify your work for an employer eligible for the program and then submit a PSLF form through your loan servicer before Oct. 31, 2022.

Chapter 5

Borrowers Defense to Repayment

Borrower’s Defense to Repayment is a national student loan forgiveness program created in 1993.

Although this program has been around for quite some time, recent revisions by the Department of Education have opened its doors to help tens of thousands more students across the country.

If you are a student attending or who has attended school with financial aid from the government, and you feel that your school has misled you or engaged in misconduct in any way, you may qualify for Borrower’s Defense to Repayment.

Students accepted into the program are relieved of partial or full responsibility to repay their federal student loans, and are, in some cases, reimbursed for amounts that were already paid.

Now it’s not as easy as it sounds. You need to prove you were misled by your school.

Who Qualifies for Borrower Defense to Repayment Loan Forgiveness

Under the law, you may be eligible for borrower defense to repayment forgiveness of the federal student loans that you took out to attend a school if that school misled you, or engaged in other misconduct in violation of certain state laws.

Specifically, you may assert borrower defense by demonstrating that the school, through any act or omission, violated state law directly related to your federal student loan or to the educational services for which the loan was provided.

You may be eligible for borrower defense regardless of whether your school closed or you are otherwise eligible for loan forgiveness under other laws.

The regulations are subject to change by the Department of Education until it acts:

If your institution shuts down after July 1, 2020, while you are still a student, it’s up to you to apply for borrower defense relief. Those debts were formerly immediately canceled.

Even if the Education Department has discovered malfeasance on the part of your institution that qualifies for student loan forgiveness, you will still have to apply. No forgiveness is immediate.

Under the new standard, you must show that your institution intentionally deceived you and that you suffered identifiable financial losses as a result. The loan itself does not constitute financial injury, but being unemployed as a consequence of your program might.

You may submit a claim under the new regulation if you depart from your institution 180 days before it closes. This increases the previous time limit of 120 days by a significant amount.

The old regulation permitted six years for an application to be made. The new regulation reduces that period to three years.

If your claim is initially denied and new information becomes available, you won’t be able to resubmit it for further consideration.

Here is the application form to apply for Borrower Defense :

To apply for federal student loan forgiveness based on borrower defense, submit an application in ONE of the following ways:

- Complete an online application form, which can be submitted electronically. Within the online application form, you will be required to upload an electronic version of your signature.

You can include additional documentation as part of your application by uploading additional electronic documents (for example, scanned PDF documents).

2. Complete a fillable PDF application form, print it and sign it.

Send your completed form to the U.S. Department of Education by email to [email protected] or by regular mail to the U.S. Department of Education, P.O. Box 429060, San Francisco, CA 94142.

Note

If you submit your PDF application by email, you are required to upload an electronic version of your signature.

You can use the following app to fill out and sign your form

If you have additional documents that you would like to include as part of your emailed application, please include the documents with your email (for example, by attaching scanned PDF documents).

If you choose to submit additional documents as part of your borrower defense application, the following types of documents are among those that may be helpful to your application:

Documentation to confirm the school for which you are applying for borrower defense

- your program of study

- Your dates of enrollment—such as transcripts, enrollment agreements, and registration documents

- Promotional materials from the school Emails with school officials

- Your school’s manual or course catalog

Note

ED and/or your federal student loan servicer(s) will contact you once the review of your claim is complete to inform you of whether your claim was successful or denied.

How to Write a Defense To Repayment Letter

- A written statement saying that you “Wish to assert a borrower defense to repayment based on state law.”

- Your first, middle, and last name (use your official legal name)

- Your date of birth

- Your home address

- Your email address

- Your telephone number

- The last four digits of your Social Security number

- The name and address of the school you attended

- The name of the certificate or degree program you earned or were seeking to complete (both people who completed their programs, and people who didn’t, are eligible for a defense to repayment discharge)

- The dates you were enrolled at the school

- Documentation to prove that you were enrolled in the school for the program you specified (use your transcripts or registration docs for this)

- A detailed explanation of how your school defrauded you, including a description of which state law or cause of action your school violated, an explanation of how their alleged misconduct affected your decision to attend the school (and take out loans to pay for the program), and the damage you’ve suffered (likely an explanation of your ruined finances) as a result of the school’s alleged behavior

Contact a Student Loan Advisor

If you think that the above list of requirements seems simple, please read through them again to be sure that you fully understand what you’re being asked to provide.

This is not a simple yes/no type application, or even a basic multiple-choice type form. You’ve literally got to prove the fact that you were defrauded (lied to in some way), and screwed over by your school.

For most people, that’s not an easy argument to make, so if you aren’t a great writer, then I’d advise you to consult with an attorney or student loan advisor for assistance to ensure that your application is rock-solid.

Chapter 6

Paying Student Loans Fast

Use Auto-Pay

Set up an automatic direct debit from your checking account to make the monthly payments on your loans. Borrowers with auto-debit are much less likely to miss a payment.

Many lenders offer discounts for borrowers who set up auto-debit. Federal loans offer a 0.25% interest rate reduction, while private student loans often offer a 0.25% or 0.50% interest rate reduction for the remainder of the repayment period.

Some lenders will require electronic billing to get the discount.

Pay High-Interest Debt First

Student loans do not have prepayment penalties. (You are not penalized if you pay off your student loan in one large lump sum or make more than the minimum payment) Making an extra payment can save you money.

After making the required payments, direct any extra money toward accelerating repayment of the most expensive debt first. The most expensive debt is the highest interest rate, not the lowest monthly payment.

Usually, this is credit card debt and private student loans. Paying an extra $100 on a 10% loan is like earning 10% interest, tax-free, and may save you more than $200 over the life of the loan, depending on the type of loan.

Case Scenarios

Example: If you can afford it, treat the loan like a mortgage and make larger

payments to cut the principal more quickly.

For example, A $25,000 student loan with 6.8% interest with a 10-year payback period would cost $288 a month. Paying $700 a month instead of $288 enables the borrower to repay the loan in just over three years.

Another strategy is adding payments and sending in checks every two weeks rather than monthly.

Decrease Your Budget

If you want to find more money but can’t easily increase your income, decreasing your budget is an option. While it may sound extreme, some have trimmed their budget drastically.

The key to success: you only have to do this short-term. It’s not for the rest of your life, but rather a short period where you’re focused on paying off student loans faster. A few common options are:

- Cancel cable TV or any Subscription-based service you don’t use.

- Don’t go out to restaurants

- Give up alcohol

We recommend using Truebill.

Your subscriptions are identified by Truebill so you can stop paying for things you no longer need. Your concierge is available to cancel unwanted memberships so you don’t have to.

Key Feature:

- Manage My Subscriptions -Truebill identifies your subs. Allows you to cancel in one place

- Save Hundreds Per Year – Put your money back in your pockets A dollar saved is a dollar earned.

- See Customized Budget – Effortlessly build a custom budget Track all expenses. Save for goals.

Refinance Your Student Loans to a Lower Interest Rate.

fortunately, for many graduates, refinancing may be a wonderful way to assist with loan payments.

First, you have to ask yourself why you are refinancing. Do you want to lower your interest rate, or would you like a longer term to lower your payments? Once you have determined why you want to refinance.

You can explore the following student loan refinancing Companies

- https://www.lendkey.com/

- https://www.credible.com/

- https://www.sofi.com/

- https://www.earnest.com/

All of these companies offer competitive rates with a variety of term lengths, ranging from 5 years to 20 years:

If you have private and federal loans, SoFi may be your best bet, as they will refinance both loan types together.

It is important to apply to several different lenders. Odds are not all of them will offer the same interest rate and terms, so shop around and get the best deal you can find.

You can check your rate in under 3 minutes.

Learn a Side Hustle

Many people have turned to side hustles to help them pay off their student loans. A side hustle is a job or business that you do on the side of your regular job. Side hustles can be a great way to make extra money, and they can also help you build skills and experience that can help you in your career.

There are many different types of side hustles, so there’s likely one that would be a good fit for you. Some popular side hustles include:

- Freelance writing

- Freelance graphic design

- Remote Customer Service

- Tutoring

- House sitting/pet sitting

- Babysitting

- Dog walking/pet sitting

Recommended Sites to Learn Any Skill

Udemy – Choose from 183,000 online video courses with new additions

published every month. Learn more.

LinkedIn Learning– LinkedIn Learning is a site that offers online video courses in many different subjects, including freelancing, graphic design, tutoring, and many more. The courses are taught by experts in their field, and they’re designed to help you learn new skills and improve your career. Learn more.

Skillshare – Explore your creativity with thousands of classes in illustration, photography, design, film, music, and more. Learn more.

Fiverr – Learn proven methods, processes, and best practices – and apply them to your work immediately. Learn more.

Recommended Sites to Find An Online Side Hustle

Virtual Vocations – Virtual Vocations is a small company with a big mission. We’re revolutionizing the way job-seekers find remote jobs. As a 100% remote company, they understand the unique challenges job-seekers face when looking for virtual work because they’ve been there. Get started.

Fiverr – On the other hand, Fiverr is an online marketplace for low-cost freelancers from all over the world. Clients may pay in advance for Gigs, which are any digital service ranging from WordPress design to logo creation to writing services, as well as voiceover work. Get started.

Chapter 7

Improve Your Credit

You will be angry with me today, but I have some terrible news for you. Your credit score will not improve until your student loan debt is reduced.

I’ve noticed that people engage in various strategies to avoid paying off their student loans and improving their credit. This irritates me tremendously!

You will not see significant changes in your credit score unless you make a plan for your debt. Even being in a $0 dollar plan is better than staying in forbearance.

You can defer repayment of your subsidized loan’s interest because the government is paying it. (Deferment is acceptable since the government is covering the interest on your subsidized loans.)

Student loans fall under amounts owed, payment history, and types of credit.

Favorite Tool to Build and Improve Credit

Self, formerly known as Self Lender, is a financial services company that offers two different products aimed at helping customers with bad or little credit.

The Credit Builder Account is the company’s flagship product, which allows you to get a credit-building loan in the form of a certificate of deposit (CD) that matures after you’ve completed your installments.

They provide an array of financial services, including a credit card that may help you build your credit. These items are also accompanied by excellent mobile and internet account management services.

THANK YOU

I hope that this guide has piqued your interest in “Crushing Your Student Loan Debt.”

Finally, if you’d want to book a consultation with one of our student loan experts, Call Now.

Thank you for reading this guide, and I wish you the best of luck as you work to repay your student debt!