If you’re looking for an easy way to track your expenses and keep your budget on track, Truebill may be the app for you.

But it’s not perfect for everyone, and there are a few things to consider before you decide whether or not to download it.

Keep reading for our full review of this popular budgeting tool.

Truebill Overview

You’re looking for an easy way to track your expenses and keep your budget on track, but you don’t want to spend hours of time managing it.

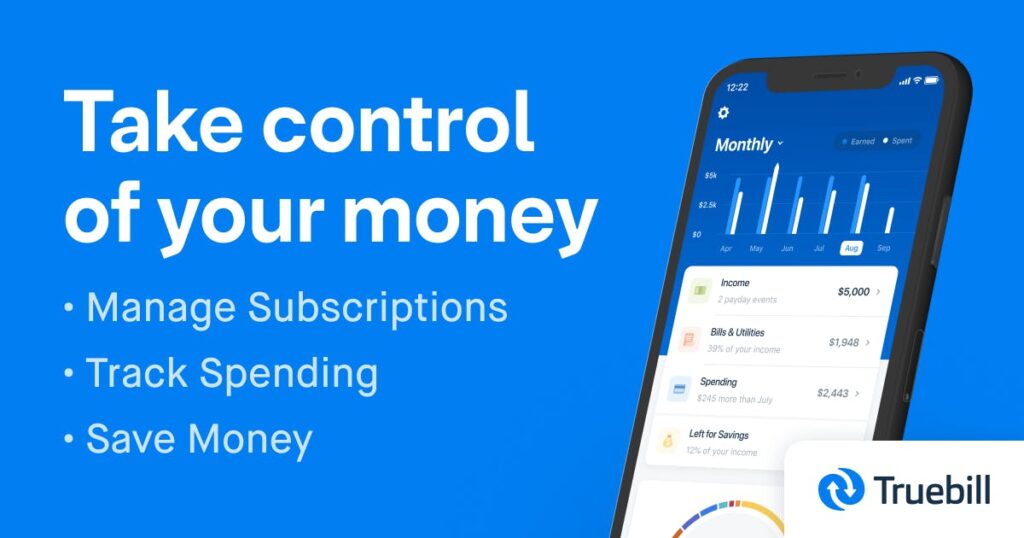

Truebill is a budgeting and finance app that helps optimize spending by tracking expenses and providing alerts when bills are due. It also has features like automatic bill pay, which can save time and money in the long run.

How Truebill Works

Let’s begin by getting a clear perspective of what Truebill does. Truebill is designed to “optimize your spending, manage subscriptions, lower your bills, and stay on top of your financial life” as stated on its website.

Truebill is a firm that helps consumers reduce their bills, manage subscriptions, seek refunds, and use premium services. The service may be divided into four parts: Reduce Your Bills Managing Subscriptions Seeking Refunds and Premium Services.

Lowering Your Bills

Truebill is a free service, right? That depends on your perspective, I suppose. It’s true that there is no upfront cost for Truebill to attempt to lower your expenses, but you won’t see those savings unless the company is compensated.

Truebill charges 40% of the saved money as a “savings fee” for every dollar gained through its use. This fee is charged after the savings are established and is only valid for one year’s worth of savings.

You’ll be charged $200 if Truebill saves you $500 a year on your bill. If Truebill is unable to find savings for you, it costs you nothing.

Truebill will ask you to supply information about some of your monthly payments during a four-step procedure when you create an account.

Managing Subscriptions and Recurring Bills

After you’ve set up some bills for Truebill to analyze, the next service it is going to pitch you is managing your monthly subscriptions.

Seeking Refunds for Fees and Outages

Truebill offers the service of sending a letter to banks in order to request refunds for overdrafts or late fees on connected accounts. This process is initiated through the dashboard after you set up your account. It’s worth noting that not all banks will allow Truebill to do this on your behalf, so you may be stuck doing some of the legwork.

Truebill Features

The app has a number of features that can be helpful in managing your money.

Feature 1:Track and understand your Credit Score

When you’re trying to be financially responsible, it’s important to track your credit score as well. This number is a reflection of your creditworthiness, so you’ll want to keep an eye on it and make sure it’s as high as possible.

Luckily, Truebill can help with that! The app has a built-in feature that will track your credit score and provide you with helpful tips to improve it. This is a great way to stay on top of your finances and make sure you’re always in good shape.

Feature 2:Get the best rates on your existing bills

One of the best features of Truebill is that it can help you get the best rates on your existing bills. This can save you a lot of money in the long run, and it’s a feature that definitely sets it apart from other budgeting apps.

How does it work? Simply put, Truebill will negotiate better rates for you with your existing service providers. This could include cable, internet, or even cell phone service. And the best part? You don’t have to do anything! Truebill will take care of everything for you.

Feature 3:Get a pay advance when you need it

Another great feature of Truebill is that it can help you get a pay advance when you need it. This can be a lifesaver in a tough situation, and it’s something that not many other budgeting apps offer.

How does it work? If you’re in need of some extra cash, Truebill can help you get it. The app will connect you with a lender who can provide you with a pay advance. This is a great way to cover unexpected expenses or get through a tough time.

Feature 2:Create a budget that works for you

Creating a budget that works for you is one of the most important things you can do to improve your financial situation. And Truebill can help with that!

The app has a variety of features that can help you stay on track and make sure your budget is effective. For example, it has a built-in feature that will track your spending and provide you with helpful tips to stick to your budget. It also offers a great way to get the best rates on your existing bills, which can save you a lot of money in the long run.

So if you’re looking for an easy way to create and stick to a budget, Truebill is definitely worth checking out.

Feature 3:Understand and grow your net worth

One of the most important things you can do to improve your financial situation is to understand and grow your net worth.

The app has a variety of features that can help you track your net worth and make sure it’s always growing.

If you’re looking for a budgeting/finance app to help optimize your spending, manage subscriptions, and lower bills – then Truebill is definitely worth checking out.

It has all of the features that make it easy for consumers to reduce their bills, manage subscriptions, track credit scores and seek refunds or use premium services.

is truebill safe?

Truebill has a security guarantee for consumers to be confident that their money, data, and privacy are protected.

is truebill free?

There is no cost to download the app and use it to monitor your expenditures or budget. Truebill offers a premium subscription that costs $3 to $12 a month (the features are identical regardless of how much you pay).

Final Thoughts: Is Truebill Worth It?

Truebill has the potential to benefit certain customers. Let’s take a look at some of TrueBill’s benefits and drawbacks to determine whether it’s right for you:

Pros Cons

Catches service outages

Takes 40% of savings

Monitors subscription renewals

Cons

Requires access to sensitive personal information

No subscription fee for basic service

Has negative reviews on Better Business Bureau website

Honest review: is that if you keep track of your money and spend within your means on a monthly basis, Truebill isn’t for you.

However, if you’re too occupied to keep track of auto-renewing subscriptions or outages, the free service may be worth it. After all, 60% is better than 100% in terms of uncovered savings.